Previous Classes + Events

Our educational series, workshops, and groups are designed to empower you to own the drive to pursue entrepreneurship. Our class and event lineup include business planning courses, special topics such as accounting, legal or marketing, networking events, and small accountability groups that can help you feel connected, supported and confident to move forward.

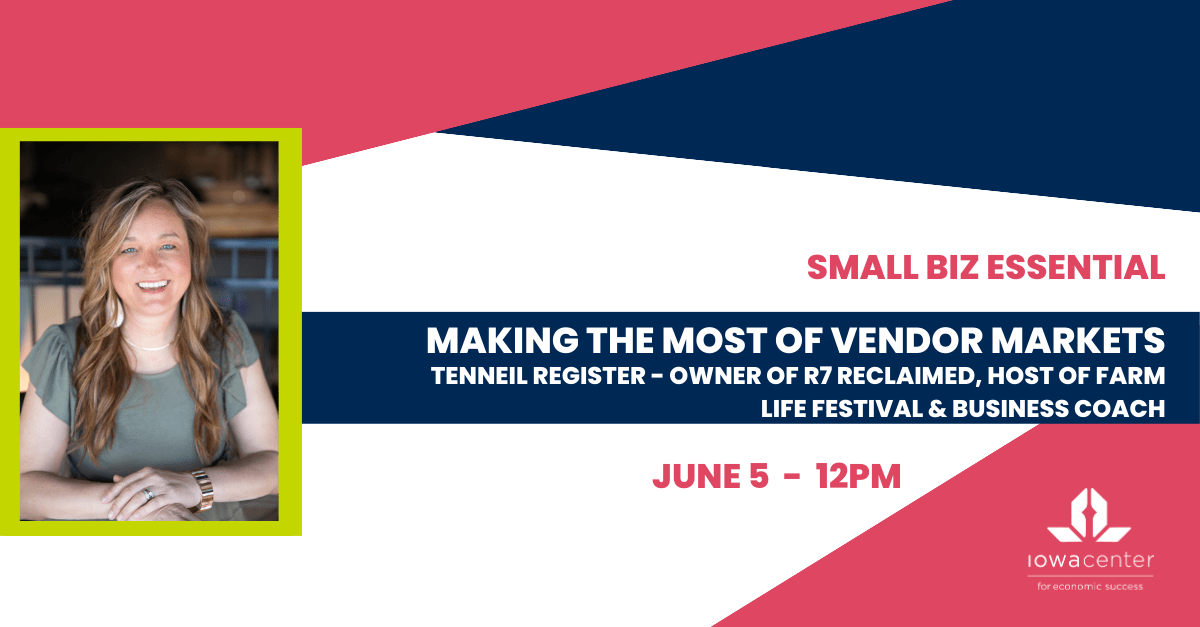

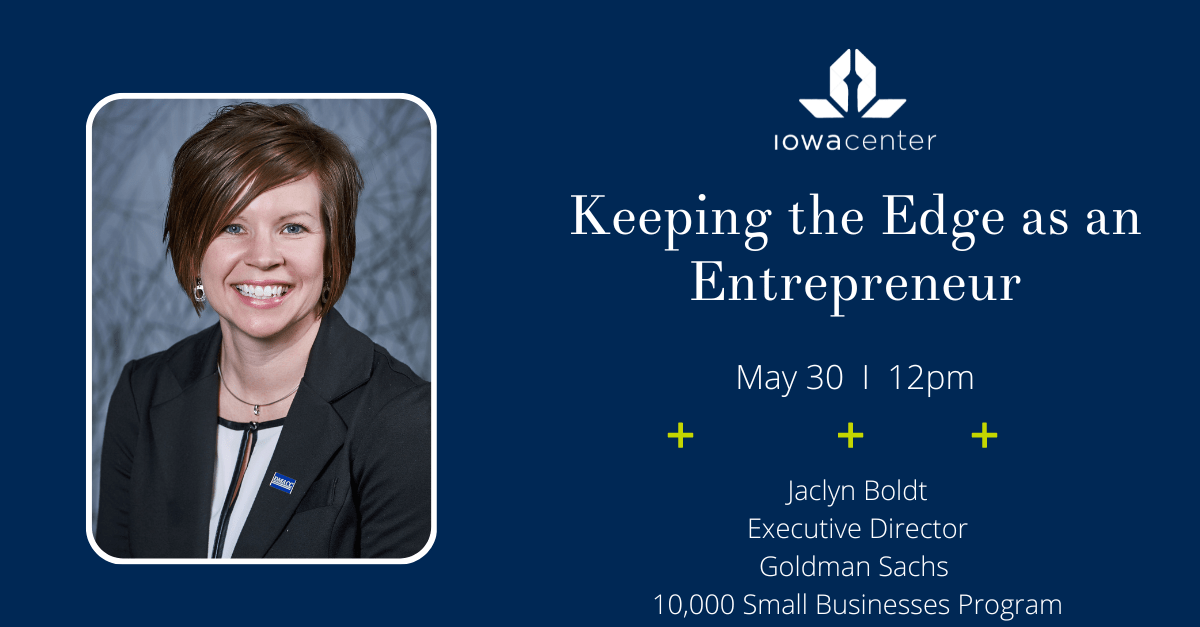

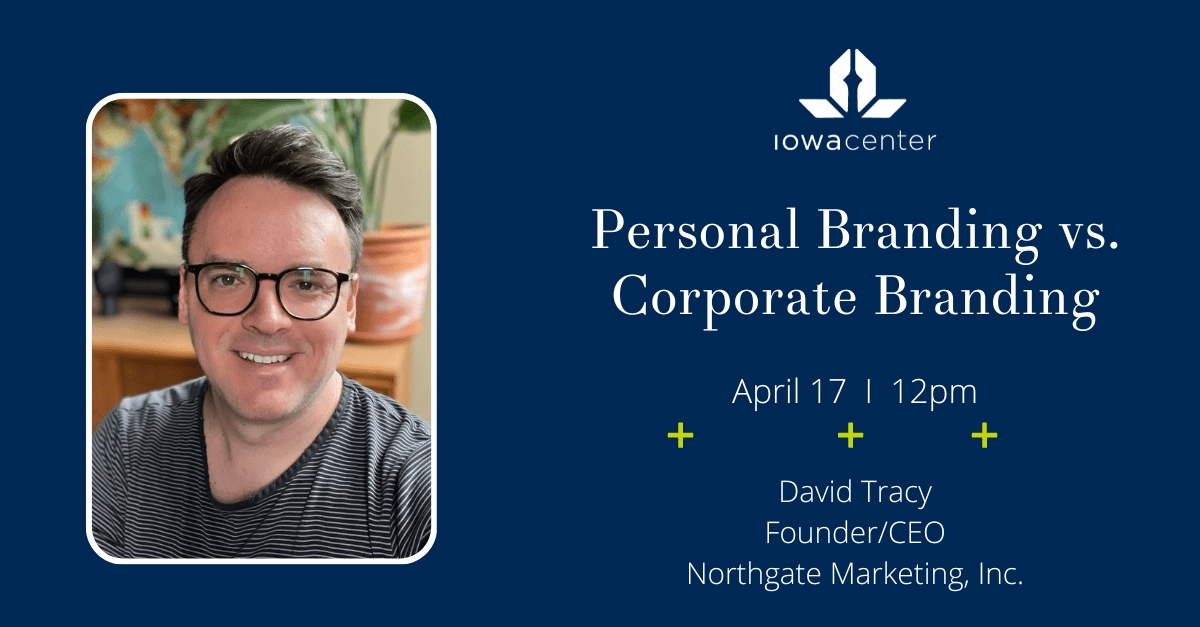

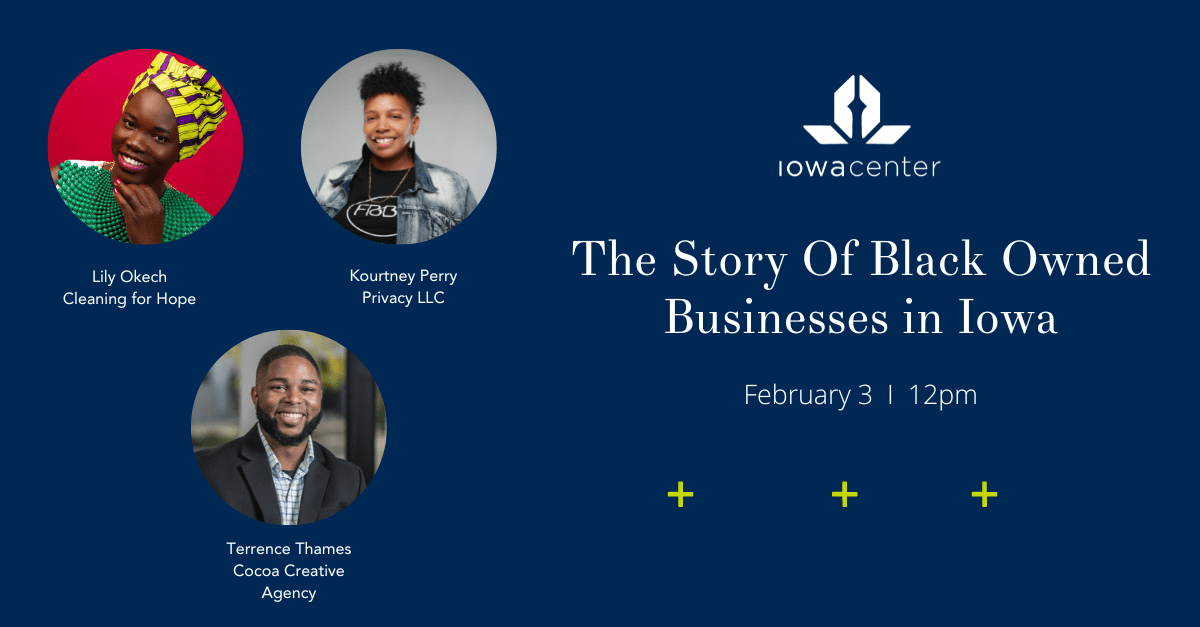

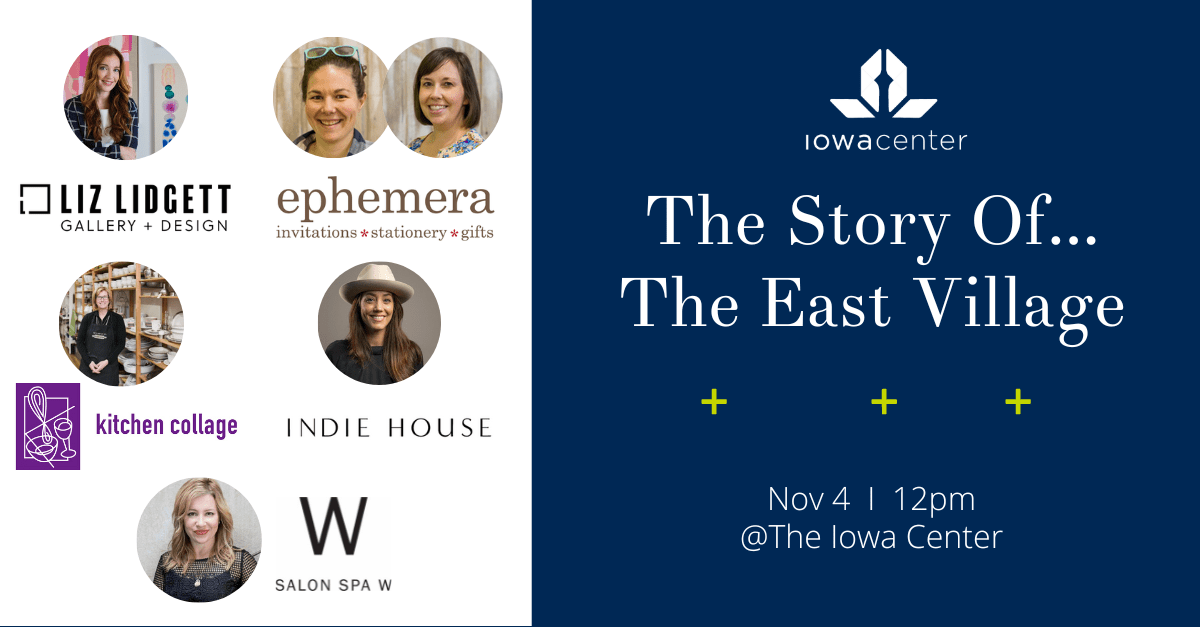

Below are available recordings from previous live webinars, classes and events. (Click on the event graphic to view the video.)

To view upcoming events please click here.

The Iowa Center Women’s Business Center is funded in part by U.S. Small Business Administration.